Introduction: Why Transitioning from Saving to Investing Matters

Saving money is the first step toward financial security, but it’s only part of the equation. While saving helps you build a safety net, investing allows you to grow your wealth over time. However, making the transition from saving to investing can feel overwhelming.

The good news? You don’t need to be a finance expert to invest wisely. By understanding the right time to start and choosing low-risk investment options, you can build long-term financial stability without unnecessary stress.

In this guide, we’ll cover:

✅ The key differences between saving and investing

✅ How to know when you’re financially ready to invest

✅ Low-risk investment options for beginners

✅ Practical strategies to balance saving and investing

Let’s get started! 🚀

1. Saving vs. Investing: What’s the Difference? 💰

Before you take the leap into investing, it’s essential to understand how it differs from saving.

Saving

✔️ Short-term financial security – Best for emergencies and planned expenses

✔️ No risk – Your money remains safe and accessible

✔️ Low returns – Interest rates on savings accounts are usually very low

Investing

✔️ Long-term wealth building – Helps money grow over time

✔️ Some level of risk – Markets fluctuate, but smart investing minimizes losses

✔️ Higher potential returns – Can significantly outpace inflation

💡 Example: If you save $10,000 in a regular savings account with a 0.5% interest rate, you’ll earn $50 per year. But if you invest it in an index fund with an average return of 8%, your money could grow to $21,589 in 10 years!

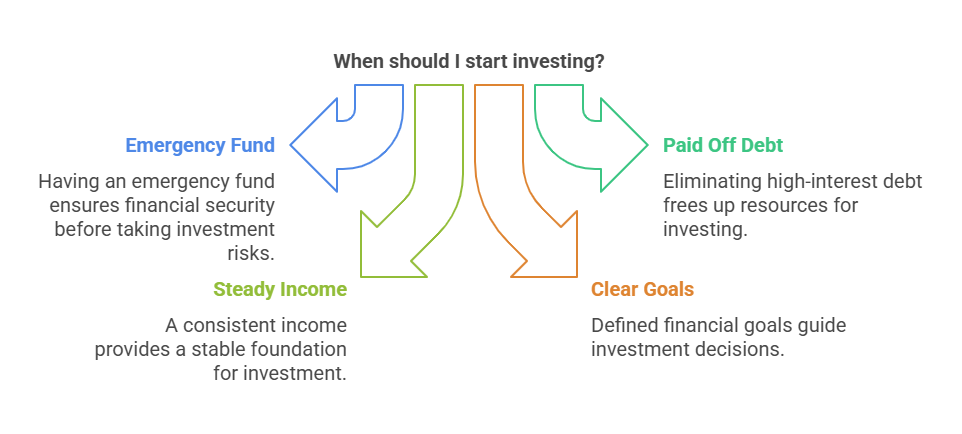

2. When Should You Move from Saving to Investing? ⏳

Not everyone is ready to start investing immediately. Here are key signs that it’s the right time for you:

1. You Have a Fully Funded Emergency Fund

Before investing, ensure you have at least three to six months’ worth of essential expenses saved in an easily accessible account. This ensures that unexpected costs—such as medical bills or job loss—won’t force you to sell investments at a loss.

2. You Have Paid Off High-Interest Debt

If you have credit card debt or high-interest personal loans, it’s best to pay them off before investing. The average credit card interest rate is 16-25%, which is much higher than most investment returns. Paying off debt first saves you more money in the long run.

3. You Have a Steady Income

A stable job or reliable income stream ensures that you can consistently contribute to your investments without financial strain.

4. You Have Clear Financial Goals

Are you investing for retirement, buying a home, or planning for future expenses? Having a goal helps determine the best investment strategy.

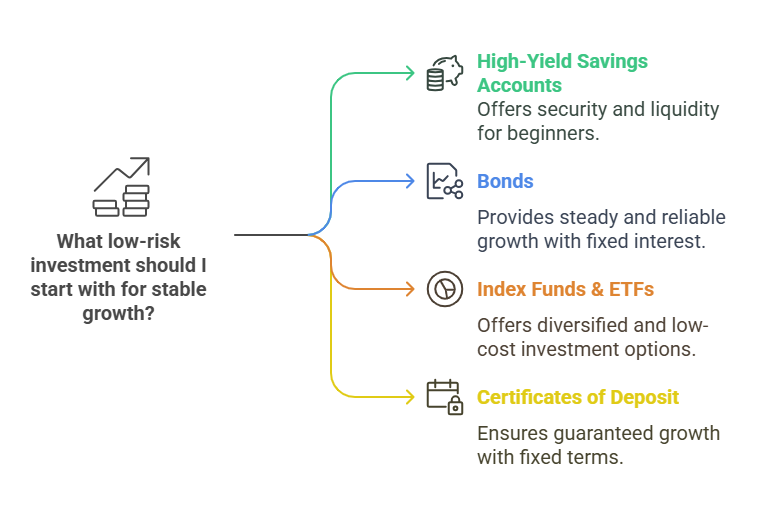

3. How to Start Investing with Minimal Risk 📈

If you’re new to investing, it’s natural to feel hesitant about risk. Fortunately, there are several low-risk investment options that offer steady returns while protecting your money.

1. High-Yield Savings Accounts (HYSA) – The Best Place to Start

A high-yield savings account is a risk-free way to earn better interest rates than a traditional savings account. These accounts are ideal for short-term savings and emergency funds.

🔹 Pros: Zero risk, easy access to funds, FDIC insured

🔹 Cons: Lower returns than other investment options

2. Bonds – Safe & Predictable Growth

Bonds are loans you give to the government or corporations in exchange for fixed interest payments. They are less volatile than stocks and provide a steady income stream.

🔹 Government Bonds: Safe, backed by the government (e.g., U.S. Treasury Bonds)

🔹 Municipal Bonds: Issued by local governments, often tax-free

🔹 Corporate Bonds: Higher returns than government bonds but slightly more risk

💡 Example: If you invest $5,000 in a bond with a 5% annual return, you’ll earn $250 per year—guaranteed!

3. Index Funds & ETFs – Diversified Investing for Beginners

If you want higher returns with lower risk, consider index funds or ETFs. These funds track the stock market and allow you to invest in hundreds of companies at once, reducing risk.

🔹 Pros: Low cost, diversified, historically strong returns

🔹 Cons: Some market fluctuations, but less risky than individual stocks

💡 Best beginner-friendly index fund: Vanguard S&P 500 ETF (VOO) – Low fees, steady growth.

4. Certificates of Deposit (CDs) – Guaranteed Returns

A Certificate of Deposit (CD) locks your money for a set period (e.g., 1-5 years) in exchange for higher interest rates.

🔹 Pros: Guaranteed returns, FDIC insured

🔹 Cons: Your money is locked in for a fixed term

💡 Example: A 5-year CD at 4.5% APY means that $10,000 turns into $12,462 with zero effort.

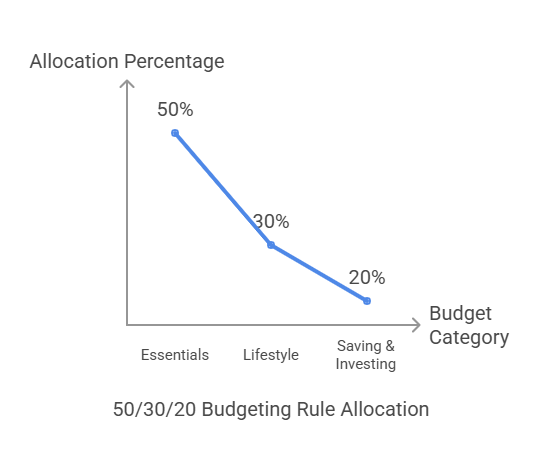

4. How to Balance Saving and Investing ⚖️

To achieve both financial security and growth, it’s important to balance saving and investing. Here’s how:

Follow the 50/30/20 Rule

This budgeting rule helps allocate your income effectively:

- 50% for essential expenses (rent, utilities, groceries)

- 30% for discretionary spending (entertainment, dining out)

- 20% for savings and investments

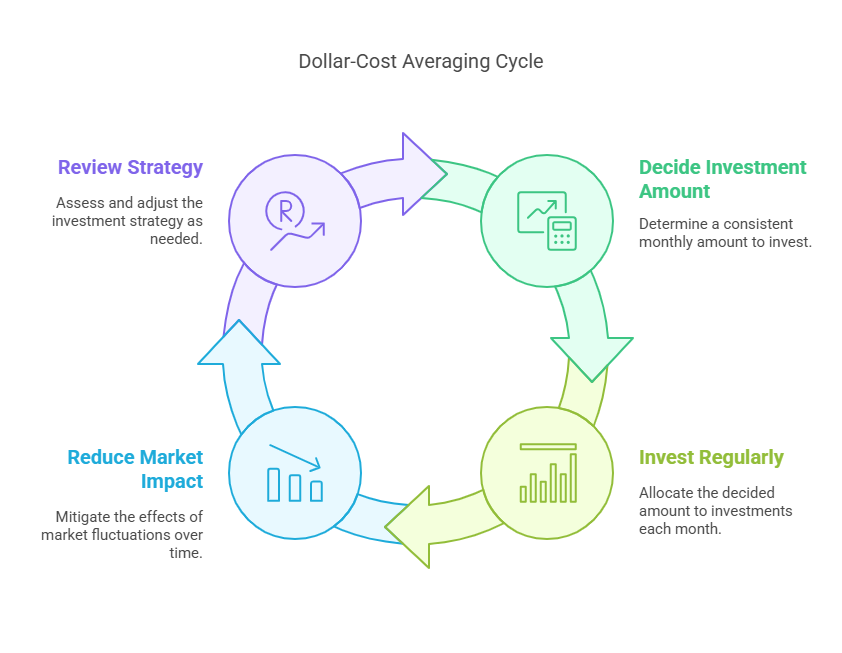

Use Dollar-Cost Averaging (DCA)

Instead of investing a lump sum, contribute a fixed amount to investments regularly (e.g., $100 per month). This strategy reduces the impact of market fluctuations.

Review & Adjust Your Portfolio Annually

Markets change, and so do your financial goals. Review your investments at least once a year to ensure they align with your needs.

Conclusion: Take the Next Step Toward Financial Growth 🚀

Making the transition from saving to investing is an important step toward financial independence. By building a solid savings foundation, choosing low-risk investments, and maintaining a balanced approach, you can grow your wealth while minimizing risks.

Key Takeaways:

✅ Savings protect your money but offer low returns.

✅ Investments grow your wealth but require smart risk management.

✅ Start with safe options like high-yield savings accounts, bonds, and index funds.

✅ Invest consistently and review your strategy regularly.

Now it’s your turn! Are you ready to take the next step in your financial journey? Let us know in the comments or ask any questions!

Would you like additional recommendations based on your financial goals? 😊