Introduction: Why Saving Matters

Saving money is the first step toward financial freedom. Whether you want to handle emergencies, buy a home, or retire comfortably, building good saving habits will help you achieve your goals faster.

Unfortunately, many people struggle with saving because of unexpected expenses, lifestyle inflation, or poor budgeting habits. The good news? Anyone can develop a strong financial foundation by following a few simple steps.

In this guide, you’ll learn how to start saving, maintain consistency, and make your money work for you.

1. Set Clear Savings Goals 🎯

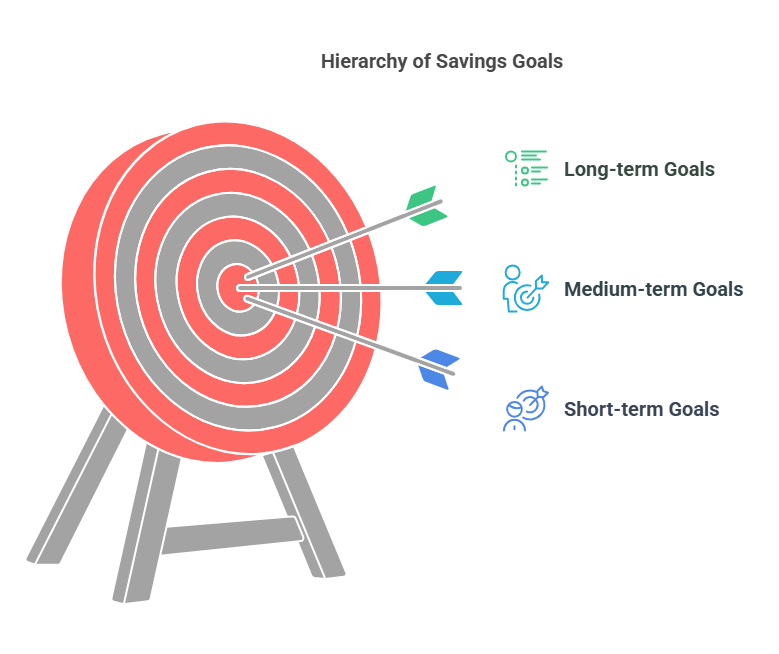

Before you start saving, ask yourself: What am I saving for? Having specific savings goals will keep you motivated and help you stay on track.

Types of Savings Goals:

✅ Short-term goals (0-2 years) – Emergency fund, travel, new phone, or minor home repairs

✅ Medium-term goals (2-5 years) – Car purchase, home down payment, starting a business

✅ Long-term goals (5+ years) – Retirement, children’s education, wealth-building

💡 Example: Instead of saying, “I want to save money,” set a SMART goal:

🚀 “I will save $5,000 for a vacation in 12 months by setting aside $417 per month.”

2. Create a Budget That Supports Your Savings Goals 📊

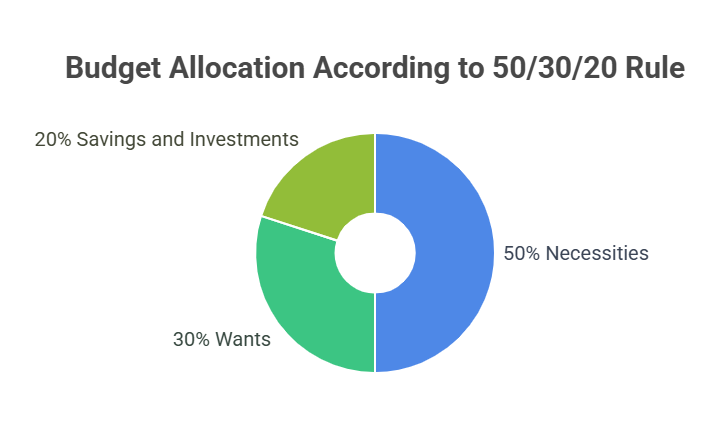

A budget is your financial roadmap. Without one, it’s easy to overspend and neglect savings.

How to Create an Effective Budget:

- Track Your Income & Expenses – Write down all sources of income and monthly expenses.

- Categorize Your Spending – Separate needs (rent, bills, food) from wants (eating out, shopping, subscriptions).

- Use the 50/30/20 Rule:

- 50% for necessities (rent, groceries, bills)

- 30% for wants (entertainment, dining out, hobbies)

- 20% for savings and investments

💡 Example: If you earn $3,000/month, you should aim to save at least $600 (20%) each month.

3. Build an Emergency Fund First 🚨

An emergency fund is a financial cushion that protects you from unexpected expenses like medical bills, car repairs, or job loss.

How Much Should You Save?

✅ Beginners: Aim for $1,000 as a starter emergency fund.

✅ Ideal Goal: Save 3-6 months’ worth of expenses in case of major financial setbacks.

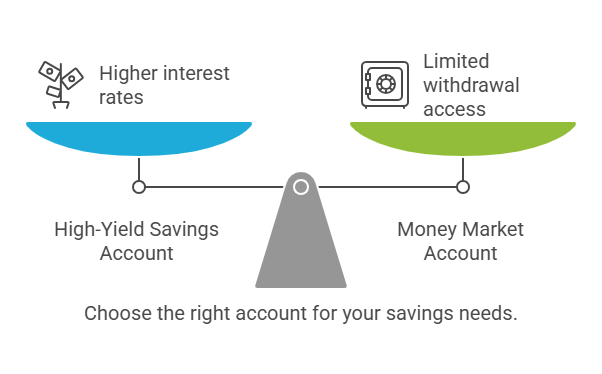

Where to Keep Your Emergency Fund?

🔹 High-Yield Savings Account (HYSA) – Offers higher interest than a traditional savings account.

🔹 Money Market Account (MMA) – A mix of savings & checking benefits with limited withdrawals.

💡 Example: If your monthly expenses are $2,000, aim for an emergency fund of $6,000 – $12,000.

4. Cut Unnecessary Expenses to Boost Savings ✂️

One of the easiest ways to save more is by cutting back on non-essential spending.

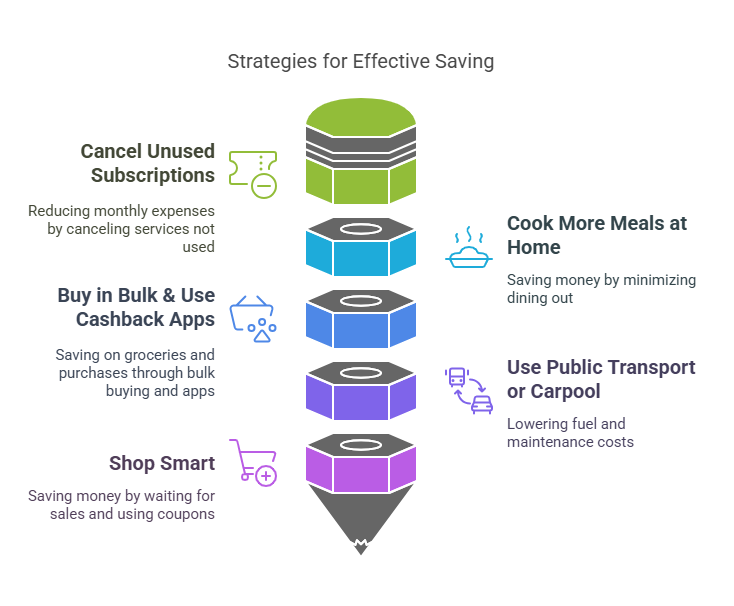

Simple Ways to Reduce Expenses:

✔️ Cancel Unused Subscriptions – Review your streaming services & memberships.

✔️ Cook More Meals at Home – Reduce dining out and coffee shop visits.

✔️ Buy in Bulk & Use Cashback Apps – Save money on groceries and daily purchases.

✔️ Use Public Transport or Carpool – Reduce fuel and maintenance costs.

✔️ Shop Smart – Wait for sales, use coupons, and compare prices before buying.

💡 Example: If you spend $5/day on coffee, switching to home-brewed coffee could save $1,800/year!

5. Choose the Right Savings Account 🏦

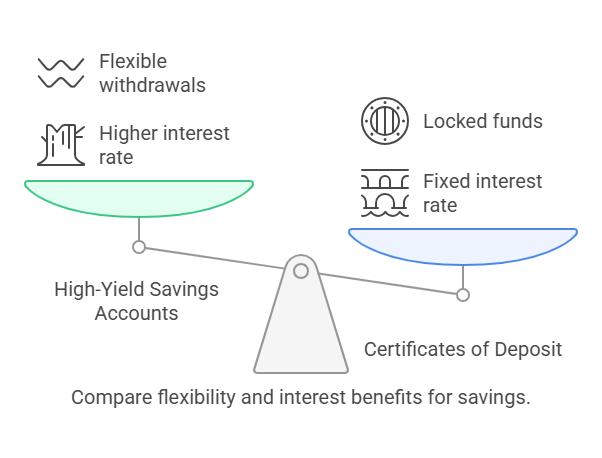

Not all savings accounts are created equal. Some offer better interest rates and benefits than others.

Best Savings Account Options:

✔️ High-Yield Savings Accounts (HYSA) – Earns more interest than standard savings accounts.

✔️ Certificates of Deposit (CDs) – Higher interest, but money is locked for a set period.

✔️ Money Market Accounts (MMAs) – A mix between savings and checking accounts with limited withdrawals.

💡 Example: If you put $10,000 into a HYSA at 4% APY, you’ll earn $400 per year in interest without doing anything.

6. Automate Your Savings for Consistency 🔄

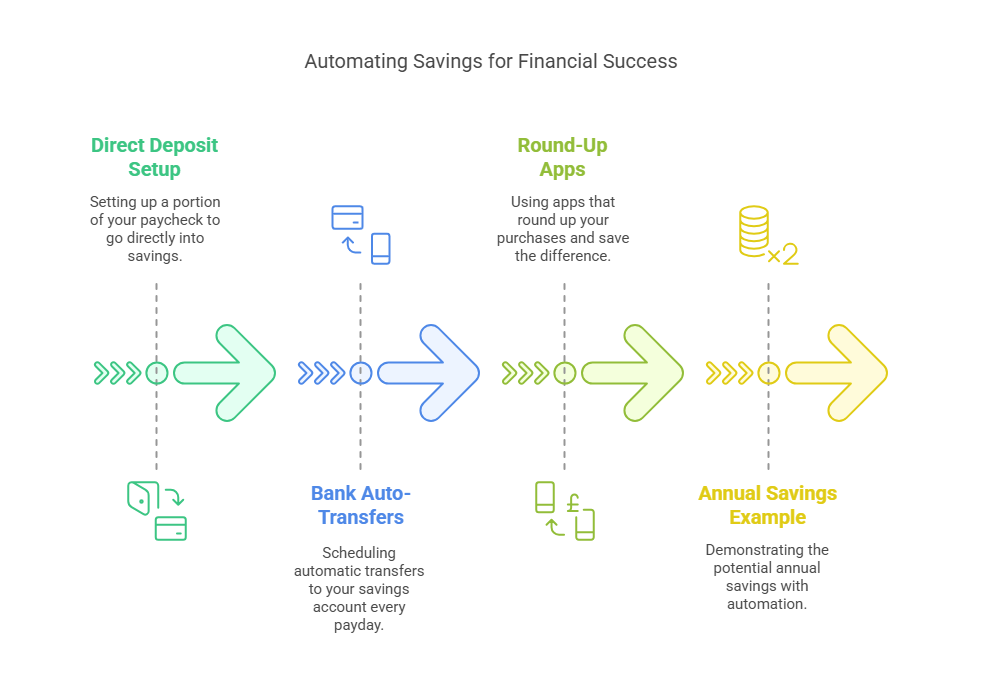

Making savings automatic removes the temptation to spend first.

How to Automate Your Savings:

✅ Direct Deposit – Set up a portion of your paycheck to go directly into savings.

✅ Bank Auto-Transfers – Schedule automatic transfers to your savings account every payday.

✅ Round-Up Apps – Use apps like Acorns or Digit that round up your purchases and save the difference.

💡 Example: If you save $50 per week automatically, that’s $2,600 in one year without even thinking about it!

7. When to Move from Saving to Investing 📈

Once you have an emergency fund and stable savings, it’s time to make your money work for you through safe investment options.

Beginner-Friendly Investment Options:

✔️ Index Funds & ETFs – Low-cost, diversified stock market investments.

✔️ Bonds & CDs – Safer options with steady returns.

✔️ Retirement Accounts (401k, IRA) – Take advantage of tax benefits and employer matching.

💡 Example: Investing just $200/month in an S&P 500 index fund could grow to $200,000+ in 30 years (assuming 8% average return).

Conclusion: Take Action Today! 🚀

Saving money doesn’t have to be complicated. By setting clear goals, budgeting wisely, cutting unnecessary expenses, and automating savings, you’ll create a strong financial foundation for the future.

✅ Start now! Even saving $10 a week adds up over time.

✅ Review your finances and find ways to cut unnecessary spending.

✅ Make saving a habit – The earlier you start, the more you benefit!

💬 What’s your biggest savings goal right now? Share in the comments!