Investing can feel overwhelming, especially with market fluctuations and financial uncertainty. But the good news? You don’t need to take big risks to grow your wealth.

Low-risk investments offer steady returns while protecting your money from major losses. Whether you’re new to investing or want to diversify safely, this guide will help you build wealth without unnecessary stress.

In this post, we’ll explore the best low-risk investment options, how they work, and how to get started.

1. Why Choose Low-Risk Investments? 🤔

Many people think investing means huge risks and stock market volatility, but that’s not always the case. Low-risk investments allow you to:

✅ Preserve your capital – Your initial investment remains safe.

✅ Earn steady returns – Even without market ups and downs.

✅ Reduce stress – No need to monitor daily stock prices.

✅ Achieve long-term growth – Slow and steady wealth-building.

💡 Example: If you invest $10,000 in a 4% high-yield savings account, you’ll earn $400 per year in passive income—without worrying about stock crashes!

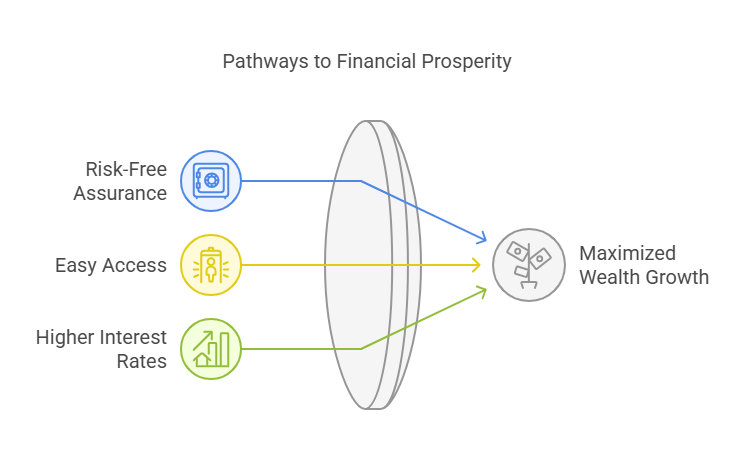

2. High-Yield Savings Accounts (HYSA) – The Safest Option 🏦

A high-yield savings account (HYSA) is one of the safest ways to grow your money with zero risk. It works just like a regular savings account but offers much higher interest rates.

Benefits of HYSA:

✔️ Risk-Free – Your money is insured (FDIC/NCUA in the U.S.).

✔️ Easy Access – Withdraw funds anytime.

✔️ Higher Interest – 4-5x more than regular savings accounts.

💡 Example: A standard bank savings account may offer 0.01% interest, while an HYSA could offer 4.5%—meaning your money grows faster!

Where to Find the Best HYSAs?

🔹 Online Banks – Ally, Marcus by Goldman Sachs, Discover Bank

🔹 Credit Unions – Navy Federal, Alliant Credit Union

3. Bonds – Safe & Predictable Returns 📜

Bonds are low-risk loans that you give to governments or corporations in exchange for fixed interest payments over time.

Types of Bonds:

✔️ Government Bonds – Issued by the government (e.g., U.S. Treasury Bonds, UK Gilts).

✔️ Municipal Bonds – Issued by local governments, often tax-free.

✔️ Corporate Bonds – Issued by big companies; higher returns than government bonds.

💡 Example: A $1,000 bond with a 5% annual yield will pay you $50 per year until it matures—guaranteed!

Best Bond Investment Platforms:

🔹 TreasuryDirect.gov (for U.S. Treasury Bonds)

🔹 Vanguard & Fidelity (for municipal and corporate bonds)

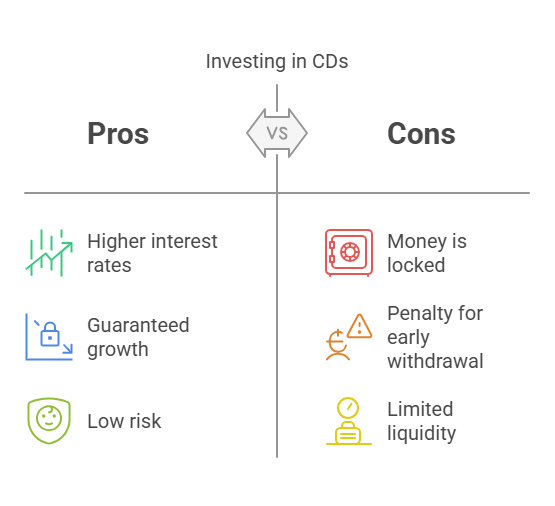

4. Certificates of Deposit (CDs) – Guaranteed Growth 💰

A Certificate of Deposit (CD) is a savings option where you lock your money for a fixed period in exchange for higher interest rates.

Benefits of CDs:

✔️ Zero Risk – Your principal is insured and protected.

✔️ Fixed Interest Rates – No surprises; your return is locked in.

✔️ Higher Returns Than Regular Savings Accounts.

💡 Example: A 5-year CD at 5% APY means $10,000 turns into $12,763 with zero effort!

Where to Open a CD?

🔹 Marcus by Goldman Sachs – Competitive rates.

🔹 Discover Bank & Capital One – Flexible terms.

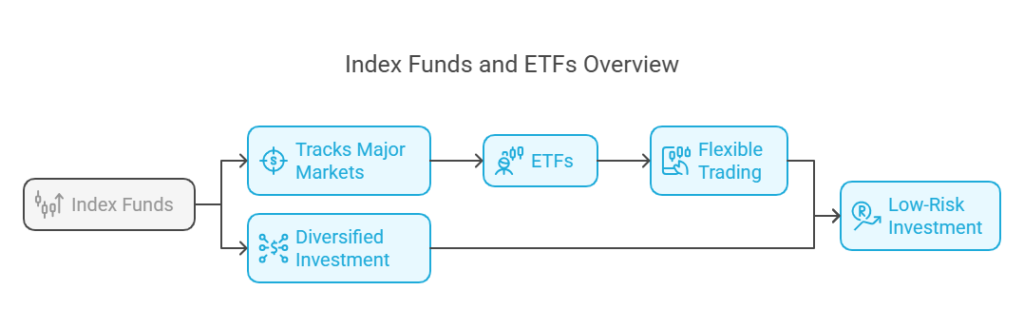

5. Index Funds & ETFs – Low-Cost, Diversified Investing 📈

If you want higher returns than bonds but less risk than individual stocks, Index Funds & Exchange-Traded Funds (ETFs) are your best option.

What Are Index Funds & ETFs?

✅ Index Funds – A collection of stocks tracking major markets (e.g., S&P 500).

✅ ETFs – Like Index Funds but traded on the stock exchange (more flexible).

Why Are They Low-Risk?

✔️ Diversification – You’re investing in hundreds of companies at once.

✔️ Lower Volatility – Less impact from individual stock crashes.

✔️ Low Fees – Cheaper than actively managed funds.

💡 Example: Historically, the S&P 500 Index Fund has returned 7-10% annually, meaning $10,000 invested today could grow to $76,000 in 25 years!

Best Index Funds & ETFs for Low-Risk Investing:

🔹 Vanguard S&P 500 ETF (VOO) – Low fees, steady growth.

🔹 iShares Core U.S. Aggregate Bond ETF (AGG) – Bond-focused, lower risk.

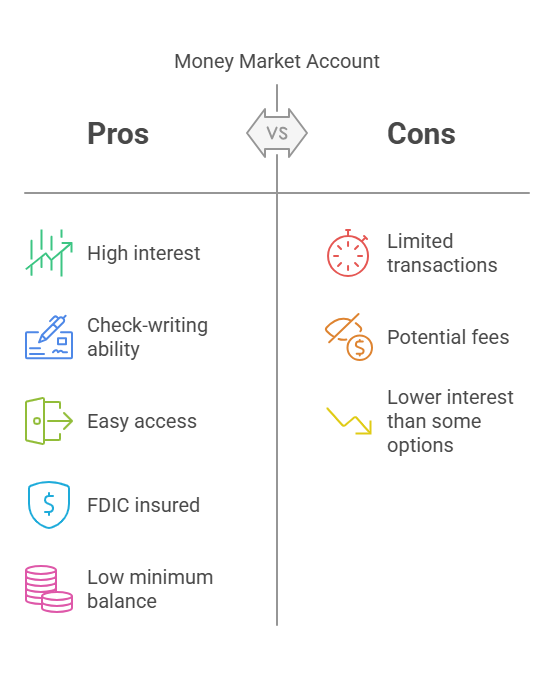

6. Money Market Accounts (MMAs) – The Best of Both Worlds 🏦

A Money Market Account (MMA) combines the benefits of high-yield savings accounts and checking accounts.

Benefits of MMAs:

✔️ Higher Interest Than Savings Accounts.

✔️ Limited Check-Writing & Debit Card Access.

✔️ Safe & FDIC-Insured.

💡 Example: If you want to earn interest but still access funds easily, an MMA is a great option.

Best Money Market Accounts:

🔹 Synchrony Bank Money Market Account

🔹 Vanguard Federal Money Market Fund (VMFXX)

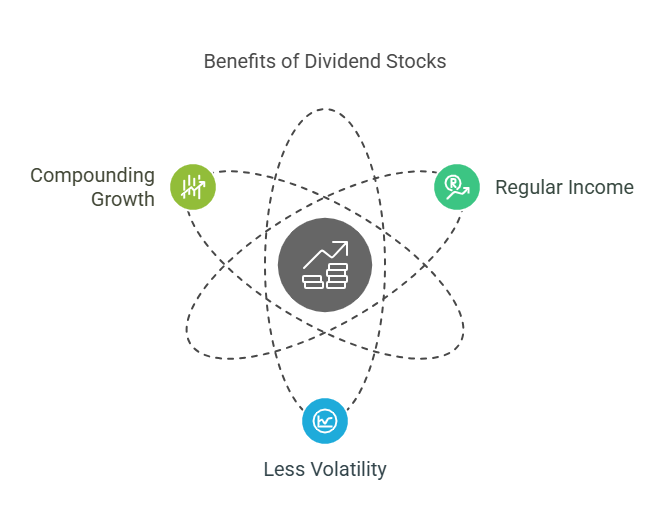

7. Dividend Stocks – Passive Income with Low Volatility 📊

Dividend stocks are shares of stable, profitable companies that pay you cash dividends every quarter or year.

Why Are Dividend Stocks Low-Risk?

✔️ Regular Income – Earn cash even if stock prices drop.

✔️ Less Volatility – Focus on blue-chip, recession-proof companies.

✔️ Compounding Growth – Reinvest dividends to grow your wealth faster.

💡 Example: A $5,000 investment in a 4% dividend stock pays $200/year in passive income!

Best Dividend Stocks for Stability:

🔹 Coca-Cola (KO) – Consistent dividends for decades.

🔹 Johnson & Johnson (JNJ) – Safe healthcare investment.

Conclusion: Grow Your Wealth with Confidence! 🚀

Low-risk investments offer steady, stress-free wealth growth. Whether you choose HYSAs, bonds, index funds, or dividend stocks, you can earn passive income while keeping your money safe.

Key Takeaways:

✅ HYSAs & CDs – Best for safe savings & guaranteed returns.

✅ Bonds & MMAs – Reliable fixed-income options.

✅ Index Funds & ETFs – Diversified, low-cost market growth.

✅ Dividend Stocks – Earn passive income & long-term stability.

💬 Which low-risk investment do you prefer? Let us know in the comments!